图表内容

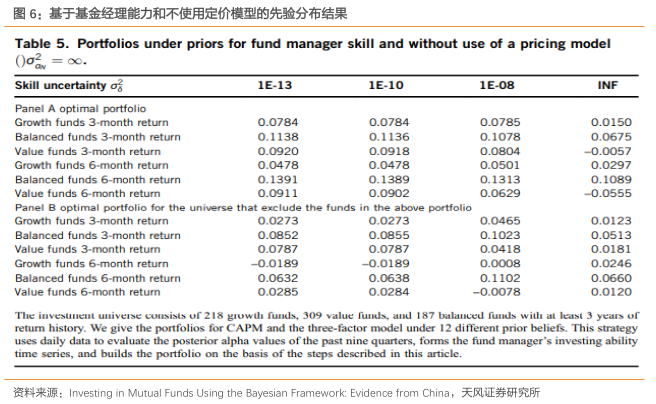

图6:基于基金经理能力和不使用定价模型的先验分布结果

Table 5. Portfolios under priors for fund manager skill and without use of a pricing mode

1E-13

1E-10

1E08

Panel A optimal portfolio

0.0785

0.1078

alue funds 3-month return

0.0920

Growth funds 6-month return

0.0478

0.0501

0.0297

Balanced funds 6-month return

0.1389

0.1313

0.1089

0.090

portfolio for the universe that exclude the funds in the a

portfolio

Growth funds 3-month return

0.0273

0.0465

Balanced funds 3-month return

0.1023

0.0513

alue funds 3-month return

0.0418

0.0181

Growth funds 6-month return

0.0189

0.0189

0.0246

alanced funds 6-month return

0.0632

0.0660

Value funds 6-month return

The investment universe consists of 218 growth funds

309 value funds

and 187 balanced funds with at least 3 years or

enum history. We give the portfolios for CAPM and the three-factor model under 12 different prior beliefs. This strategy

ily data to evaluate the posterior alpha values of the past nine quarters

forms the fund

time series

and builds the portfolio on the basis of the steps described in this article.

资料来源: nesting

k: Evidence from china

天风证券研究所